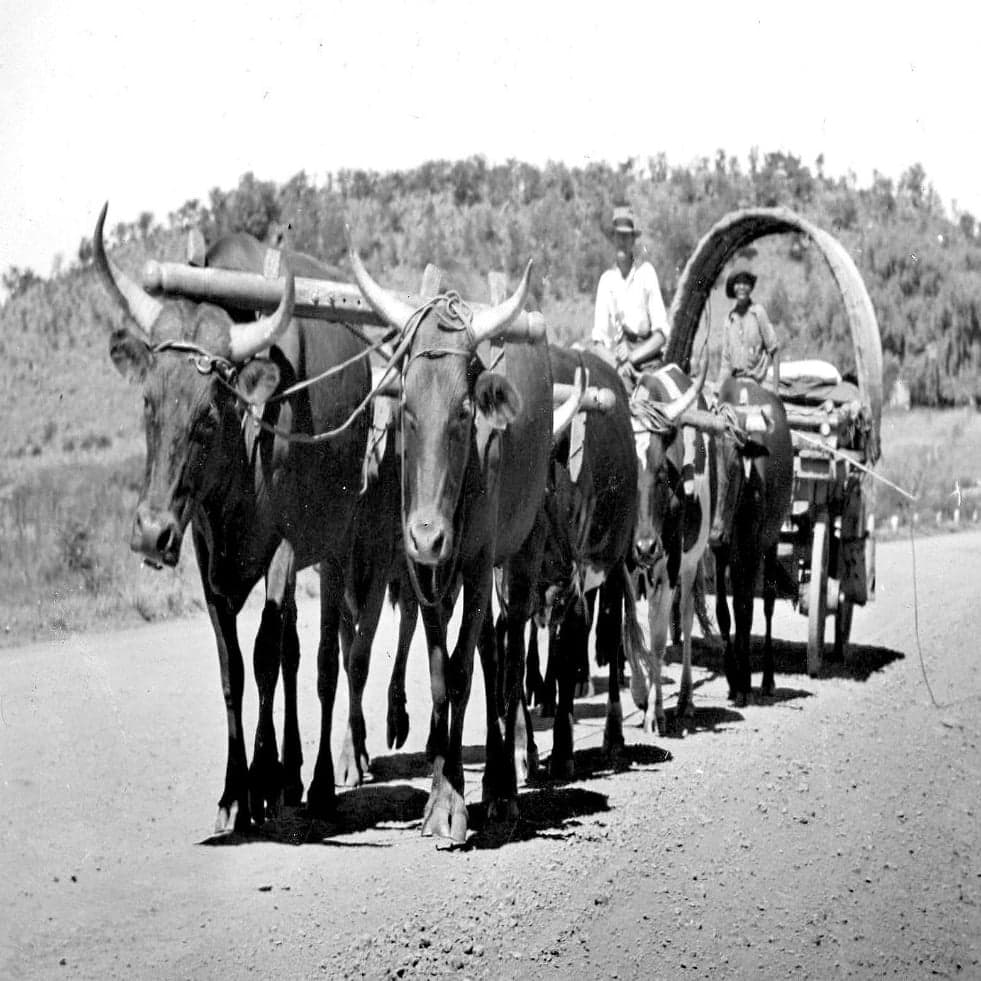

This week the globalEDGE blog will look at cash crops around the world. Cash crops are crops that are grown specifically to be sold in a marketplace or traded; essentially a crop grown not for direct consumption by the farmer. Cash crops have played a large role in shaping the world throughout history. A major factor in the colonization of the New World were the dollar signs investors saw in cash crops like tobacco and cotton in the Americas. The only reason that the New World was even discovered was because Europeans were looking for a faster route to reach China and India to trade for their tea and other spices. Tea and most spices are products of cash crops.

globalEDGE Blog - Page 95

Publish Date:

Milk has always been an essential part of India’s culture. In the early 1900’s, India's milk production was incredibly inefficient and was struggling with its limited production of milk. Until one individual, Dr. Verghese Kurien caused a dramatic change in his home country. Dr. Verghese Kurien, known as the Milkman of India, is also a Michigan State University alumnus. Dr. Kurien states himself that Michigan State University provided him with the best education and prepared him to achieve his dream.

Publish Date:

Technology is evolving rapidly in many realms of the world. Currently, the light is focused on the use of robots in warehouses. The autonomous mobile robotics (AMR) are emerging worldwide from numerous start-up firms.

Currently, Amazon is the main company producing and using automatic robots. In 2012, Amazon bought Kiva Systems turning their AMRs into their own product and rebranding them as “Amazon Robots”. These robots are said to be the future of factory work. Also, Amazon has recently discontinued the sale of their robots to other competitors such as Walgreens, Staples and The Gap, leading to a scramble of other companies worldwide attempting to enter the field.

Publish Date:

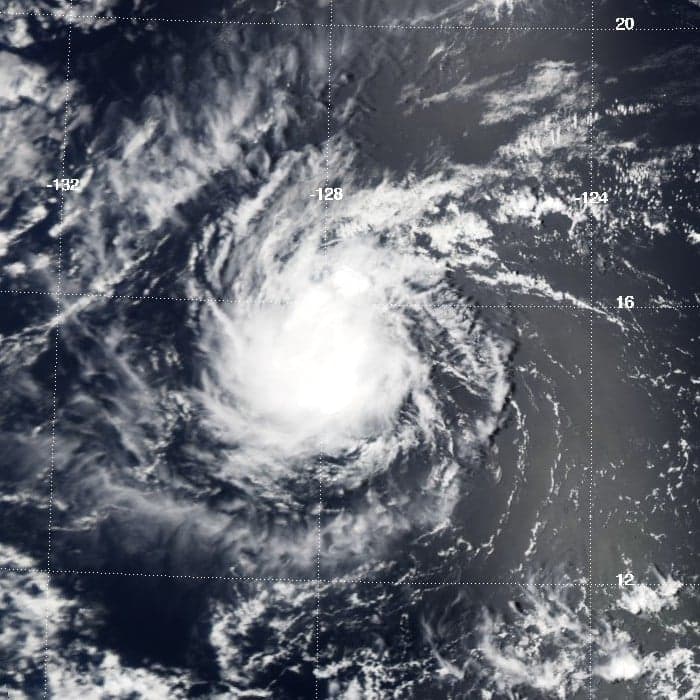

Recently, Hurricanes Irma and Harvey slammed into the coasts of the Caribbean and southern parts of the United States. These destructive tropical storms caused billions of dollars worth of damage combined and displaced millions of families. JP Morgan recently estimated that the insurance industry could lose $10 to 20 billion from Hurricane Harvey alone.

Publish Date:

Blockchain is a platform where transactions are recorded. It is an open source available for all parties involved. Participants in each transaction generally have their own ledger; however, Blockchain serves as a shared ledger. It eliminates the need for intermediaries in transactions and reduces the paper process, increasing efficiencies and lowering costs. Blockchain is known for being a platform on which Bitcoin and other cryptocurrencies trade, however, it is not limited to that.It can track all sorts of data in a structured format.

Publish Date:

Driverless, or autonomous, cars have been in the news a lot this past year. Essentially it is a car that can drive itself with no help needed from a human driver. There are many people who believe this is the next big development in the automotive industry. We are still several years off from driverless cars being fully implemented on the road. According to a plan laid out in the U.K. last year driverless cars are to be implemented fully and on the road by 2025.

Publish Date:

It is no shock that developing countries have the lowest access to healthcare. According to the Global Economic Symposium, “low and middle-income countries bear 93% of the world´s disease burden, yet account for only 18% of world income and 11% of global health spending.” While this lack of access to medical services is common on the demand side of the healthcare industry due to people not being able to afford the costs of the treatment, another prevalent issue occurs on the supply side.

Publish Date:

In the world today, everyone is looking into shortcuts for everything from cooking to driving and now for payment methods. The world as a whole is becoming a paperless society. According to a Business Insider report, more than one trillion dollars are exchanged through peer-to-peer (P2P) payments applications such as Venmo and PayPal. This number is expected to grow exponentially in the next couple of years.

Publish Date:

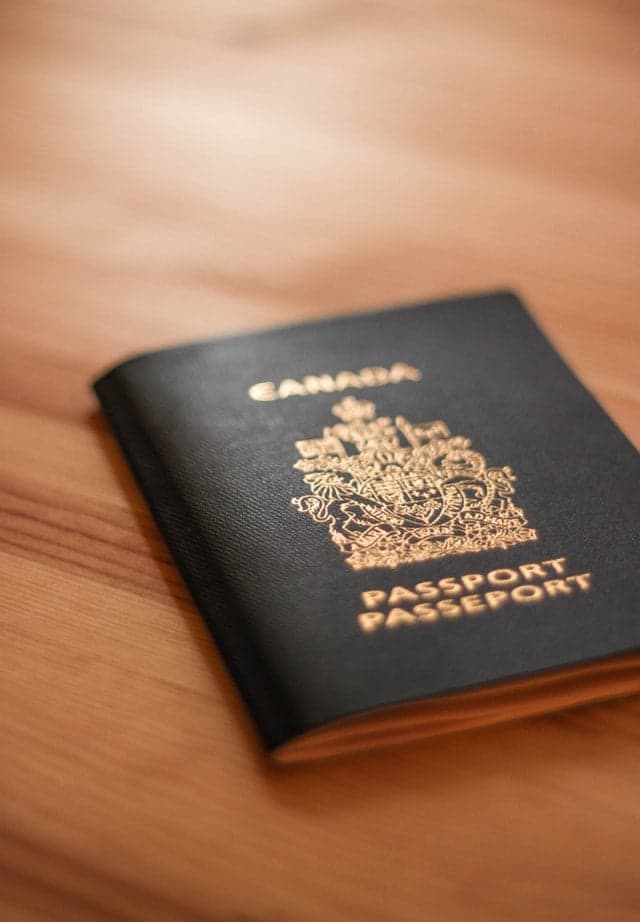

The process of acquiring a second passport as means of citizenship is continuing to grow in popularity as more countries establish themselves in the industry. For passport owners, the return on investment ranges from increased access and establishment in new markets to owning luxurious homes in coastal regions. For participating countries, the potential for job creation or financial support is among the benefits. The trend has gained significant traction, climbing to what is now a multi-billion dollar industry.

Publish Date:

Initial Coin Offerings, or ICO’s, are a new and quickly growing way for startups to raise capital. Despite being a relatively new phenomenon the total value of ICO’s has been proliferating with nearly $1.5 billion dollars being raised since the start of the year. That value seems outlandish when compared to the mere $256 million of funding that was raised in the entirety of 2016.

While the value of ICO’s has grown nearly six-fold in the past year, many people are still in the dark regarding the new trend that is sweeping investors and startups across the globe. Essentially, ICO’s are a cross between more traditional IPO’s and crowdfunding. During and ICO a company issues “coins”, or digital tokens, similar to the popular cryptocurrencies bitcoin and Ethereum. Investors can then purchase these coins and conceivably can use them to purchase a good or service from the company at some point in the future. The value of these coins will theoretically increase in value, as long as others continue to invest. An important distinction between IPO’s and ICO’s is that investors in an ICO do not receive equity in the company and don’t really have anything tangible behind their investment besides a promise for the ability to be able to purchase a good or service from the company in the future. A second differentiator between traditional methods of raising capital and ICO’s is the amount of regulation. Given that the concept of an ICO is so new, the space is largely unregulated allowing companies to prepare for and launch in ICO in a matter of weeks as compared to the months it takes for companies to clear regulatory approval for IPO’s.