Online streaming services are spreading all around the world and are eating away from the traditional cable service. With access to the internet around the world becoming easier as ever and subscription prices to video streaming services dropping every year, there is no reason why online video streaming companies will soon be the norm around the world. Amazon Prime, Netflix, Hulu, and HBO NOW are some of the common names that fall under the streaming bucket in the US. However, we now see some of these companies begin to dominate also in international markets as both Netflix and Amazon are now present in more than 190 countries, which represents 97% of the global market.

globalEDGE Blog - By Author: Ramie Taher

Publish Date:

Tech firms have been innovating and growing freely with no strings attached for the past few decades. However, governments and politicians in the America and Europe have been growing a negative sentiment towards the freedom of the giant tech firms. Companies that fall under the social media, search engine, and e-commerce buckets have been specifically put under the microscope. The whole world is currently watching Mark Zuckerberg’s, the Founder and CEO of Facebook, testimony where he has been drilled with 100s of questions revolving around Facebook’s business model, monopolistic power, and the company’s lack of responsibility and respect towards its users data. The real question here is: should governments intervene and regulate these industries?

Publish Date:

In simple terms, inflation rates measure what has happened to consumer prices over the latest 12-month period. But what increases inflation? Well, economic growth is generally followed by a stronger and growing labor market, which means that unemployment is down and wages are increasing. This increases consumer’s disposable income and increases the cost of wages for companies. Both of those factors push prices up for consumers, which in turn, increases inflation rates. This is where interest rates, inflation’s best friend, comes into play. Shortly after inflation increases, interest rates begin to increase to control inflation (generally to 2%). Governments increase interest rates to incentivize people to save a larger chunk of their disposable income and decrease discretionary spending, in turn, decreasing consumer prices.

Publish Date:

Companies often seek growth opportunities by acquiring a company or merging with one either within its borders or internationally. Successful M&As (mergers and acquisitions) have proven to be one of the most effective ways to increase a company’s sales and/or profitability. It is also a method to push competitors outside the picture and take a larger part of the pie. M&A’s face a long list of challenges when it comes to M&A, but one of the most significant obstacles companies face in the pre-deal stage is government intervention.

Publish Date:

This is the first post in a five-part blog series focused on the consumer products industry.

This month’s blog series will provide an overview of the consumer product industry and its future outlook, and then we will analyze the industry by region: North America, South America, Asia, and Europe. By the end of this week, these blogs will offer you a thorough summary of what’s happening in the consumer product industry and emphasize the importance of the industry in the global market.

Publish Date:

What does full employment really mean? Full employment in an economic point of view does not necessarily mean everyone has a job. If employment drops beyond a certain point, it can generate price and wage pressures, which might spark an inflation. Therefore, economists refer to the term as the sweet spot, where employment is close to full and does not push prices up.

Publish Date:

With the new tax reform coming into place, many American firms are expected to repatriate money from abroad, especially from the EU, with a reduced price tag. Interestingly, there is about $2.5 trillion of unremitted foreign profits accumulated over the past three decades that are expected to come back to the US. The US government expects to collect around $339 billion in the next decade in repatriation tax.

Publish Date:

The UAE and Saudi governments have finally implemented the Value Added Tax (VAT) system on the 1st of 2018, after more than year of planning. Many business and individuals are still struggling to grasp how to handle this new tax system. The VAT was set at 5% in both countries and is expected to stay at that rate. This rate applies to almost every good or service one purchases daily, with the exception of certain specified items stated by each government.

Publish Date:

This month marks the 10-year anniversary of the ‘Great Recession.’ The subprime mortgage crisis ignited the 2008-09 financial crisis in the US, which rippled through almost every market in the world causing a global meltdown. America itself is estimated to have lost about $4 trillion from the financial crisis and its labor market has not yet recovered ever since. So, what should we expect this upcoming year?

Publish Date:

The maritime industry is being revolutionized this year, with the introduction of “smart ships.” The maritime transport carries more than 90% of world trade annually and is the most cost-effective mode of transportation for mass goods and raw materials worldwide. Advancements in technology have built a strong platform for the creation of autonomous ships. The sensory technology and algorithms needed for a virtual captain already exist and it’s only a matter of time until we see unmanned ships.

Publish Date:

Many companies seek growth opportunities through integrating either vertically or horizontally with other companies. Vertical integration is a strategy where companies expand their business into their production chain (backward integration) or distribution path (forward integration), and these are generally achieved by M&A or internal growth. While horizontal integration is when a company acquires or merges with another company on the same level of the value chain, in other words, a competitor.

Publish Date:

This blog analyzes A.T. Kearney’s Global Trends 2016-2021 report, which focuses on Political, Technological, and Demographic Revolutions. Today, I will specifically go into the 3rd trend in the report, which talks about how the Global Labor Market is approaching a tipping point. The growing labor market in the last couple of decades has been one of the primary drivers of global economic growth. According to data from the UN Population Division, the share of the working-age population globally has risen steadily from 61% in 1975 to 71% in 2015. However, the global workforce is now expected to level off around 70-72% through the end of the century. This tipping point will have significant implications on economies and businesses all around the world.

Publish Date:

Fair Trade has been around since the 1950s, but what exactly is Fair Trade and how has it changed since its inception? Fair Trade is global movement focused on providing over 1.6 million small-scale producers and workers with fair prices. It is an approach to commerce that eliminates forced labor, child labor, and discrimination while demanding safe working conditions, fair payment, respect for the environment, and transparency. It is an ethical method to trade and works towards alleviating poverty and sustaining development in developing nations.

Publish Date:

Nowadays, most people use their mobile devices to check on their bank accounts and pay for bills, parking, and cabs. People are also now even shifting towards making payments using their mobile devices, using apps such as Apple Pay, Android Pay, the Starbucks app, or the PayPal app.

Publish Date:

Blockchain is a platform where transactions are recorded. It is an open source available for all parties involved. Participants in each transaction generally have their own ledger; however, Blockchain serves as a shared ledger. It eliminates the need for intermediaries in transactions and reduces the paper process, increasing efficiencies and lowering costs. Blockchain is known for being a platform on which Bitcoin and other cryptocurrencies trade, however, it is not limited to that.It can track all sorts of data in a structured format.

Publish Date:

Let’s start with a quick overview of what a cryptocurrency is. It is a digital currency and is known for its unique feature, in that it is not issued by any central authority, therefore, cannot be controlled and manipulated by any government. Bitcoin is one of the oldest and most popular cryptocurrencies. It, as well as the other cryptocurrencies, are stored and transferred on Blockchain – a peer-to-peer network that validates and records all transaction and is considered to be the ledger for all cryptocurrency transactions. This network eliminates the need for a middle man (financial institutions), however, there are miners who validate the transactions through a process called “mining” and are rewarded free bitcoins for their work. It is important to know that Blockchain’s uses are not limited to just cryptocurrencies and many industries are discovering how they could take advantage of this ledger system. For the sake of simplicity, I will be focusing primarily on one cryptocurrency, Bitcoin, as there are more than 900.

Publish Date:

The world is going through a major demographic transition. Population growth is decreasing around the world, while the age distribution is leaning towards the elderly. But how would this alter any economy? Population growth plays a key role in every economy in the world, where a lower population growth rate means that there will be fewer workers and consumers. An aging population would lead to a smaller working-age population, which would decrease the growth of the labor force. Both of these trends result in lower GDP growth.

Publish Date:

As the world is becoming more connected, the courier, express & parcel (CEP) industry is growing and evolving. Online shopping has induced this growth significantly, with companies such as Amazon and Alibaba playing a major role. The ease with which a consumer can find items online from a variety sellers with many delivery options and often reviews and ratings, has shifted the purchasing power significantly to the hands of consumers. This forces retailers to offer better service and cheaper delivery. This, in turn, has created a lot of issues for CEP companies and has forced them to rethink their strategies, as costs have been rising faster than revenues. Also, emails and social media have almost completely replaced the use of mail delivery, which required postal companies to shift their main focus to parcel delivery products, services, and supply chains that would create better revenue streams.

Publish Date:

Inflation plays a major role in every economy in the world and measuring it is a very difficult issue for government statisticians. A variety of indices to measure inflation exist and each country picks the indices that are deemed relevant and measure it according to their own economy. Therefore, even if two countries use the same index, the basket of goods used to measure the index will include different items that are constantly revised and updated.

Publish Date:

When experts study the economic effects of migration, the amount of money expatriates send back to their homes plays a key role in some countries. These transactions are commonly referred to as remittances, and they represent a major international financial resource in the world and a mean to reducing poverty in the developing world. Remittances also create positive spillover effects, such as improving health, education, and gender equality.

Publish Date:

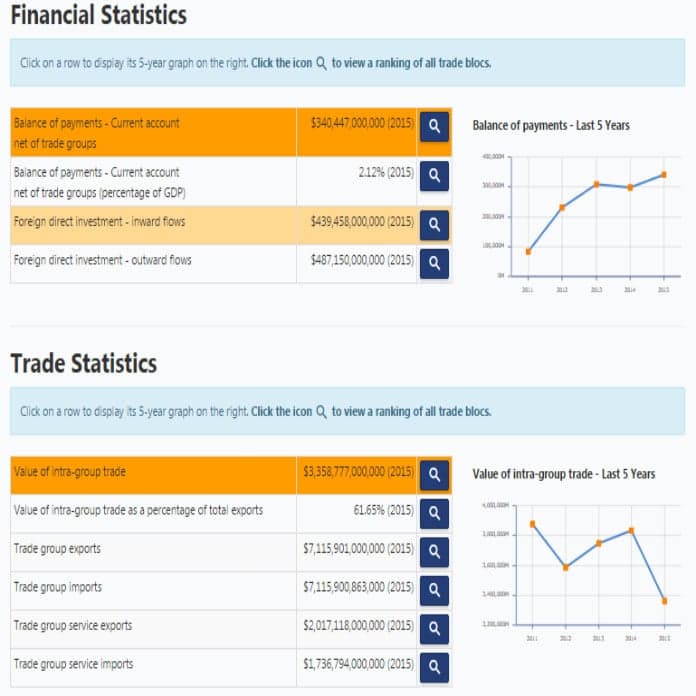

Are you interested in learning more about the value of imports, exports, and FDI flows of each trade bloc? Financial and trade statistics for all the trade blocs have been updated on globalEDGE. You can browse each trade bloc and learn more about the total amount of intra-trade, the value of exports/imports, FDI inflows and outflows, and the balance of payments of each trade group. By clicking any row of data, you can display a graph of the 5 most recent years of data available, in order to view any short to medium-run trends. Also, you can view where each trade block ranks compared to the rest by clicking on the magnifying glass icon next to the data. Check out the updated European Union statistics page!

Publish Date:

The word refugees has been thrown around quite often recently due to the several ongoing situations across the world. There is no doubt that the impact of the inflow of refugees into a country is very controversial. They have been welcomed by some and rejected by some. Some look toward the benefits and some look at the disadvantages of allowing in refugees.

Publish Date:

China was able to achieve a 6.8% economic growth rate in the last quarter of 2016, which marks the end of its constant declining growth after more than 2 years. This boost was fueled by higher government spending and record bank lending. Overall, the economy grew at 6.7% in 2016, which is within the government’s growth target but still the slowest in 26 years.

Publish Date:

As many of us know, the North American Free Trade Agreement (NAFTA) played a significant role in the US elections, with president-elect Donald Trump clearly stating that he will renegotiate the agreement with Canada and Mexico in order to stop the outflow of middle-class jobs. Changes in NAFTA would transform the auto industry in the US since it allows automakers, as well as other suppliers, to move production to Mexico without facing any tariffs and take advantage of the lower labor costs.

Publish Date:

globalEDGE provides a wealth of information on international business and a variety of interactive educational tools for use in the classroom or in executive training. One section that has been extensively used in a classroom setting is the Online Course Modules. The modules offer a structured way of viewing information pertaining international business through narrated slides. The modules cover several aspects of international business such as how to do business in several regions, importance of culture and ethics in conducting international business, the legal framework of international business, and a module series on exporting that has been produced in cooperation with the U.S. Commercial Service. The modules also include quizzes, case studies, and references for further study.

Publish Date:

Global economic growth has been held back in recent times and many factors play into this; however, political uncertainty has been at the forefront. Unpredictable political outcomes, such as the general election season in the world, instability in the Middle East, the Brexit, and China’s leadership reshuffle, have created considerable doubt and uncertainty in global markets.

Publish Date:

After the Brexit, the pound fell immensely, by 8.4% in one day, to its lowest since 1985, which was the biggest one day fall on record. Since the morning of the referendum result, the pound has deprecated by around 11% against the dollar without any large fluctuations in the last two months. The depreciation of the pound could be seen as a double-edged sword. It caused a significant boost in exports in several industries in the United Kingdom due to British prices becoming relatively lower for the world, but prices of imported goods, such as raw materials, have and will continue to rise.

Publish Date:

The European Union (EU) is working strenuously to stop giant American companies from avoiding taxes in its region. EU regulators have been studying tax arrangements between its member countries and US companies such as Apple, Amazon, Google, and McDonald’s. Just last week, the European Commission (EC) ruled that Apple owes Ireland €13 billion ($14.6 billion) in back taxes.

Publish Date:

After economic sanctions were lifted off of Iran, many countries quickly began trade talks and one of the first countries to jump on this was Germany. Large German companies, such as Siemens AG, have already announced plans for large industrial projects in Iran. German companies hoped that the removal of the embargo on Iran would reignite old trade deals that had reached $5bn in yearly exports. Although exports have jumped since January, the results have left Germans disappointed.

Publish Date:

Britain’s historic decision to leave the European Union (EU) has caused massive economic and political chaos. World financial markets tumbled immediately after the vote and the British pound fell tremendously. Britain will look to further engage in trade to offset some of its economic loss.

Publish Date:

The Gulf Corporation Council (GCC) countries have come together to reach an agreement regarding implementing the VAT (Value Added Tax) system by the end of 2018. This agreement may come as a surprise to many people, since the GCC region was known for its tax-free perks and massive income from oil. However, the circumstances now prove to be otherwise. The plunge of oil prices since last year has immensely reduced government revenues, making it a necessity for the GCC countries to find new sources of revenue and diversify their portfolio.

Publish Date:

Dubai has been one of the fastest growing economies in the past 3 decades, if not the fastest. Dubai has been all over the news and social media for quite some time now, and everyone is amused by its dramatic changes. It distinguishes itself with its ultramodern architecture, skyscrapers, and luxurious shopping. It’s also known for its indoor skiing, housing the tallest skyscraper in the world, “Burj Khaleefa”, and building man-made islands such as the “Palm Jumeirah”.

Publish Date:

For a while now, Europe has been going through a wide variety of issues. Whether it’s the refugee crisis, risk of Britain voting to leave the European Union, or Greece’s economic disaster, Europe has been set back recently. Despite these issues, European leaders cannot afford to lose sight of their long-term economic goal, “Growth.” Europeans need to act now due to the continent's aging population that creates a significant barrier for economic growth. Statistics show that by 2050, the EU labor force could shrink by 42 million, or 12%, making growth almost impossible to achieve.

Publish Date:

Going back to the early 2000's, African countries were too risky to invest in, as they were vulnerable to a variety of problems. African bonds were virtually nowhere to be found, with South Africa the only Sub-Saharan country selling dollar-denominated bonds at the time. Year after year, other Sub-Saharan African Countries have gradually begun issuing sovereign debt.