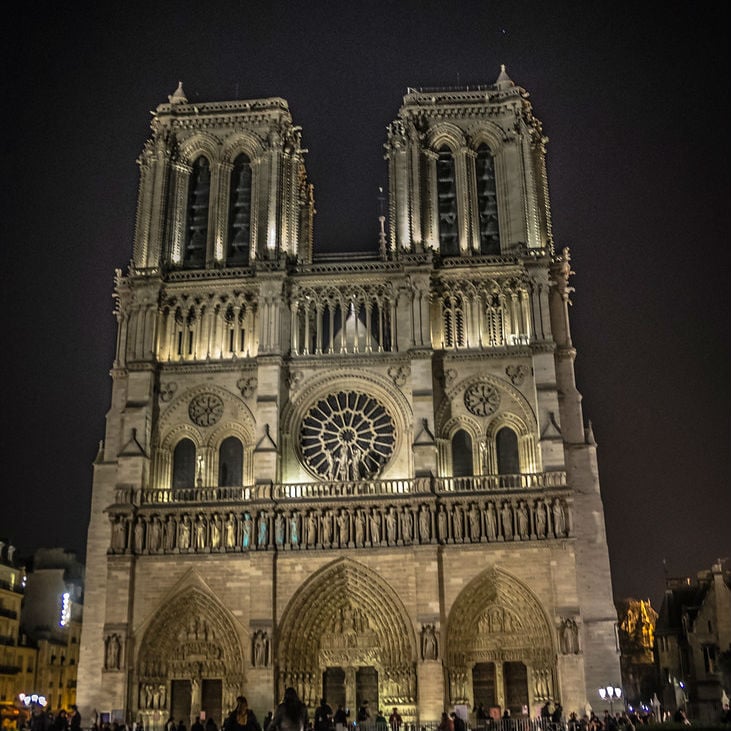

On Tuesday 4/16, French President Emmanuel Macron vowed that the Notre Dame Cathedral will be rebuilt within five years. There is hope that the reconstruction will be complete prior to Paris hosting the 2024 Olympics.

globalEDGE Blog - By Author: Kevin Caldwell

Publish Date:

After a disappointing jobs report in February, the labor market rebounded with a strong report in March. The reported number significantly exceeded analysts expectations of 170,000 jobs in March. This positive information calmed investors regarding the strength in the United States economy. This was signaled by a rise in many government bond prices. Furthermore, investors concern of wage growths’ impacts on inflation has been marginalized. Steady wage growth has been reported but not at the exuberant level some analysts had predicted. Inflation threatens bonds value because it erodes the purchasing power of predetermined payments.

Publish Date:

After years of discussion, Brande’s municipal council approved plans in mid-March to construct what will be Western Europe’s tallest skyscraper. It is scheduled to be completed in 2023 and will stand approximately 1,050 feet high be visible from up to 40 miles away.

Publish Date:

In a recently published report by the Economist Intelligence Unit, Singapore was named the most expensive city in the world for the 6th consecutive year. It was joined by Paris and Hong Kong for a three-way tie for the number one spot.

Publish Date:

The development of fracking has created a revolution in the United States oil and gas industry. Following a conference in Houston, analysts have projected the U.S. to surpass Russia and Saudi Arabia to become the world's top crude exporter within the next few years. The U.S. is projected to double its gross crude oil exports to 4.2 million barrels per day by 2024. Additionally, the United States is expected to account for 70% of the total increase in global production capacity over the next 5 years. Directors for the International Energy Agency have crowned this the “Second wave of the U.S. shale revolution”. Additionally, there is a $2.5 billion project being discussed that would carry wind and solar energy from Iowa into the Chicago area. This ‘cord’ is estimated to be 349 miles long and would connect to a power grid serving 13 midwestern states.

Publish Date:

As stated by Capital Economics’ Chief Asia Economist Mark Williams, “China’s time as an emerging markets outperformer is ending”. The reasons for this include high levels of debt, a declining working-age population, and lower levels of productivity. This has the potential to send shockwaves through countries supply chains and force companies to look elsewhere when seeking imports. The Chinese government is planning to cut taxes and boost military spending as a cash injection into the economy, but analysts remain skeptical. Last year, China reported growth of 6.6%, anything below this mark would be a new three-decade low.

Publish Date:

We are approximately a decade since the United States last recession and the U.S. Federal Reserve is coming close to finalizing a plan on how to reduce its balance sheet. At its peak, the portfolio was valued at over $4.25 trillion. The Federal Reserve purchased these securities, of which are mostly mortgage-backed securities in three rounds of stimulus that began in 2008 and finished in October 2016. The selloff of securities began in 2017 and plans to sell the majority of their holdings before the conclusion of 2019.

Publish Date:

As climate change increasingly becomes a bigger issue, investors and companies are looking for ways to minimize their environmental impact with regards to greenhouse-gas emissions. Investors such as Aviva Investors and Aegon Asset Management are encouraging restaurants and food companies to reduce their carbon footprint and redefine their supply chain to be more environmentally friendly. Especially in the United States, this is a controversial period for this issue. Analysts are expecting climate change to be a key issue in the United States 2020 presidential election. It will be a tough negotiating point between all parties involved.

Publish Date:

After recent meetings in Switzerland, the International Monetary Fund cut forecasts of global economic growth in 2019 to 3.5%. This is down from a projected 3.7% released in October and 3.9% in July. In past meetings, the organization characterized growth as “plateauing” but now has come to the agreement that the “global expansion has weakened”.

Publish Date:

Later this year, the United States and the European Union will begin trade negotiations, which the EU has already been preparing for. The relationship, which fosters $1 trillion in commercial trade could see a complete overhaul in 2019. The EU’s executive body will begin to meet this month and will structure the bloc’s parameters for which it will use in negotiations.

Publish Date:

China has successfully landed on the far side of the moon, something that no country has done before. This is a major step in challenging the United States' supremacy regarding space research and travel. President Xi Jinping has announced ambitious space travel goals, including a lunar base by 2025, the ability to man the facility by 2030, and a long-term goal of mining the moon for energy resources. With these announced plans, there is pressure mounting on the United States to continue to reach new solar milestones. Right now, the U.S. isn’t planning to return to the moon until 2023.

Publish Date:

In a report released by The National Retail Federation, U.S. holiday retail sales in November and December are expected to grow between 4.3 and 4.8 percent over 2017 sales. This will create an approximate spending of around $720 billion. In the United States, record-low unemployment numbers combined with strong consumer confidence has led to these bullish estimates regarding holiday shopping. Deloitte is predicting that U.S. e-commerce sales could reach $134 billion this holiday season.

Publish Date:

Amidst legislative restructurings revolving around Brexit, the U.K. is planning to introduce an innovative tax on large technology firms that hasn’t been done anywhere in the world. Some are considering this tax to be a raid on America tech giants. The tax applies to companies operating certain business models such as search engines, social media platforms, or online marketplaces. Specifically, U.S. tech giants such as Google, Facebook, and Amazon appear to be targeted.

Publish Date:

Electronic sports, or more commonly known as “eSports” are an online competitive platform allowing video game users to compete through online gaming. Although people have been playing computer games for over 30 years, digitalization has permitted players to gain a following of millions of fans. The global connectivity has also allowed online gaming to become more organized, competitive, and professional.

Publish Date:

Since 1912, hostels have been a centerpiece for teenagers and young adults traveling. They are overwhelmingly popular throughout the European continent, but also have a presence in most tourist-friendly countries around the world. They are a low-cost option for housing, eating, and provide an opportunity for social interaction. In an age where freelance work is becoming more common, hostels are playing an increasingly important role in travel and work abroad.

Publish Date:

Shrinking supplies from Iran, along with strong global growth has led to a bullish sentiment in future oil prices. Crude oil has rallied for four straight weeks and speculators are purchasing bullish oil options as a result. A reason for the speculation revolves around OPEC members and their inability to make up for production shortfalls amid political turmoil.

Publish Date:

There may be an unintended consequence of the White House’s trade battle with China. Companies in the Pearl River Delta, a Chinese manufacturing hub are accelerating towards making higher-quality products to compete against American goods. Recently, the U.S. government announced their plans to unveil fresh tariffs on $200 billion in Chinese products entering the U.S. Many of these products are focused on low-cost goods, of which were once the bread and butter of the Chinese economy. In response, China is hoping to be innovative and resilient as an attempt to overcome these headwinds.

Publish Date:

Since 2011, the Swedish Institute has handed over the keys to the country’s official Twitter account to a new Swede every week, letting them tweet anything they please. This tradition will come to a conclusion on September 30, 2018. The goal of this was to show the country as it really existed through the eyes of various citizens. This innovative marketing strategy has won approximately 30 awards, including the international Grand Prix, two Silver Lions in Cannes Lions, and gold at the Clio Awards. At the end of this project, 365 account users will have tweeted around 200,000 tweets on @Sweden.

Publish Date:

Recent currency declines against the U.S. Dollar highlight a dependence of emerging-market currencies on dollars. As the Federal Reserve continues to raise interest rates and subsequently boosts the power of the U.S. Dollar, some emerging markets have seen weakness in their own currencies. Two notable currencies displaying weakness are the Argentine peso and the Turkish lira.

Publish Date:

Private equity refers to the acquisition of equity in companies that don’t trade on public markets. This finance industry is relatively young in comparison to other sectors of commerce. The first firms, J.H. Whitney & Co. and the American Research and Development Corporation were both founded in 1946.

Publish Date:

As The Masters, one of golf most prominent tournaments approaches, we took a look at the state of the golf industry which is played by many individuals around the world.

Publish Date:

This is the first post in a five-part blog series focused on future trends in business.

In this weeks blog series, we plan on outlining the future of international business by taking a look at the trends of automation, sustainability, marketing, big data, and blockchain. As the fourth industrial revolution transpires, we are to expect variation with how we interact with technological devices and with how these devices communicate with one another.

Publish Date:

Canada appears to be taking the brunt of political and economic uncertainty occurring in North America. A potential renegotiation of NAFTA, US tax cuts, and a weakening oil and gas industry are leaving investors wary of future economic growth in Canada. This speculation appears to be a reality for Canada’s Finance Minister Bill Morneau, who forecasted an average annual growth of 1.7% between now and until 2022. This is a rapid change of events for the country, who saw 3.7% economic growth in the past year and the jobless rate hitting a record low.

Publish Date:

Venezuela is in the midst of a political and economic disaster and has faced hyperinflation, an increasingly worthless physical currency, and heightening food and medicine shortages. Recently, Venezuela has turned to blockchain, and the cryptocurrency boom as a potential method to fund its debt and develop a stable currency. The Petro and Petro Gold have the potential to replace the bolivar, which was the countries primary currency in the past.

Publish Date:

In the midst of an economic transformation that favors technology, the trucking industry is seeing one of its largest growth years in the past decade. In January, American trucking companies ordered the largest number of new 18-wheelers in about 12 years. This action took place following a tax overhaul that gave them more cash to invest. Trucking companies have also been incentivized to purchase new fuel-efficient trucks in a period of rising diesel costs. In a way, a digital economy has the potential to boost the growth of the trucking industry even further. Heightened packaging volumes have allowed suppliers to employ more truckers, which has boosted margins through their economies of scale. On top of this, more individuals are partaking in e-commerce, which has pressured the shipping industry to have the capability to access customers in rural areas as well as suburban and urban areas.

Publish Date:

We are almost a decade away from the 2008-09 financial crisis, and economies around the world are still expanding, almost in unison. In 2017, the world saw improvements in the labor market, positive trade growth, and rising stock markets. All of this positive data came in the midst of political turmoil across the globe including unrest in the South China sea - which is an important trade route.

Publish Date:

In October, the National Retail Federation announced that it expected holiday sales to increase between 3.6 and 4 percent in 2017. This would create a total spending of $678.75 billion to $682 billion, up from $655.8 billion last year. After the primary holiday shopping season concluded on December 24th, the U.S. economy slashed these estimates, resulting in a 4.9 percent yearly increase in this time period.

Publish Date:

As the 2018 Winter Olympic Games transcends upon us, it is an interesting time to research the Olympics business model and gain an understanding of their past successes and cloudy future

When Budapest, a frontrunner to host the 2024 Summer Olympic Games dropped out of the running, an unofficial signal was shown to the Olympic Committee that changes need to be made for the current Olympics business model. The reason being, “to avoid a loss of international prestige” as said by parliament leader, Lajos Kosa. On top of this, the 2022 Olympic Winter Games bids came down to two prospective bidders. Almaty, Kazakhstan and Beijing, China. This was due to a fair amount of potential cities failing to compete for an Olympic bid. Events like this make the rest of the world wonder, what is happening to the prestige of the Olympics?

Publish Date:

International trends regarding Foreign Direct Investment (FDI) include optimism for large developed markets, a 2016 decline in global FDI, and North America, Asia, and Europe as top FDI destinations. Due to the recent global economic growth, many developed and emerging markets have seen FDI inflows in recent years.

Publish Date:

Although modern economies have increasingly become globalized, opinions of foreign direct investments (FDI) have varied throughout human history.

Publish Date:

According to the World Economic Forum, at least $700 Billion should be invested yearly in order to monitor and maintain stable carbon levels. ‘Green financing’ is an innovative solution to this monetary issue that promotes the investment of private funds. Holistically, green financing is an idea that allows investors to profit off eco-friendly projects.

Publish Date:

This blog analyzes A.T. Kearney’s Global Trends 2016-2021 report, which focuses on Political, Technological, and Demographic Revolutions. Today, I will specifically go into the 2nd trend in the report, which talks about Latin America’s position to be a major economic player in the future.

There is a bright spot in a region historically filled with political and economic trauma. Neoliberal political parties with pro-business strategy have been winning elections across the region, creating hope for a future filled with economic prosperity. The region has deepened its ties with the rest of the world and is in the midst of reshaping its future identity.

Publish Date:

We are in the midst of the 10 year anniversary of the S&P 500’s its pre-recession high. On October 9th, 2007, this index peaked at 1,565. Since then indexed bottomed at 666 on May 6th, 2009 but has recovered. This index is currently trading around 2,550, the highest it has ever been. The United States is in the midst of the second longest economic expansion in its history. Economic prosperity has allowed the housing market to recover and the United States Federal Government has ended its policy of fiscal stimulus by normalizing interest rates. How does this compare to Europe and Asia in the same time period?

Publish Date:

Over the past decade, private equity firms have surged in popularity across the globe and have presented financiers with less regulated opportunities across international industries. Investment opportunities are typically less regulated because private firms aren’t required to register with governmental organizations who regulate the trading of shares.

Publish Date:

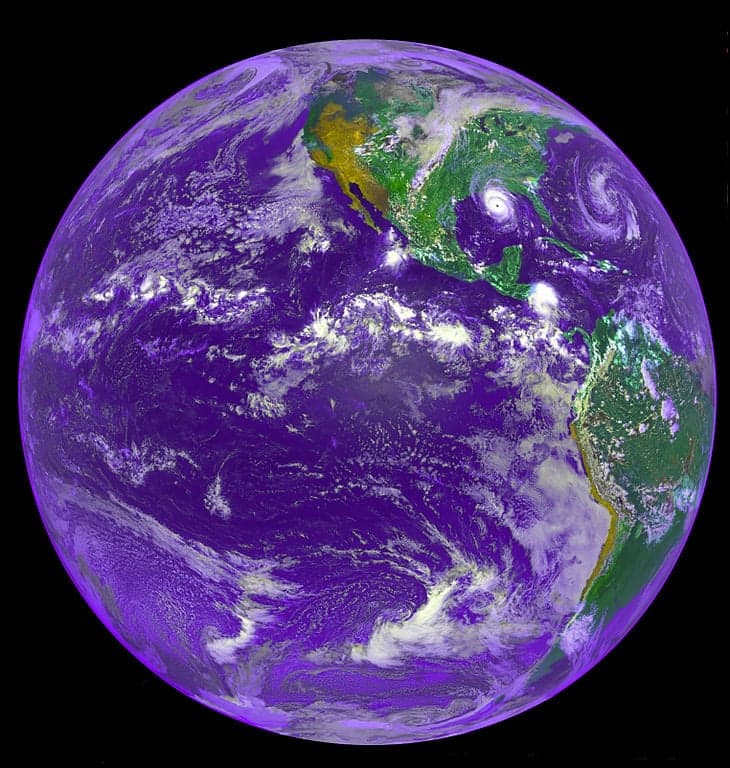

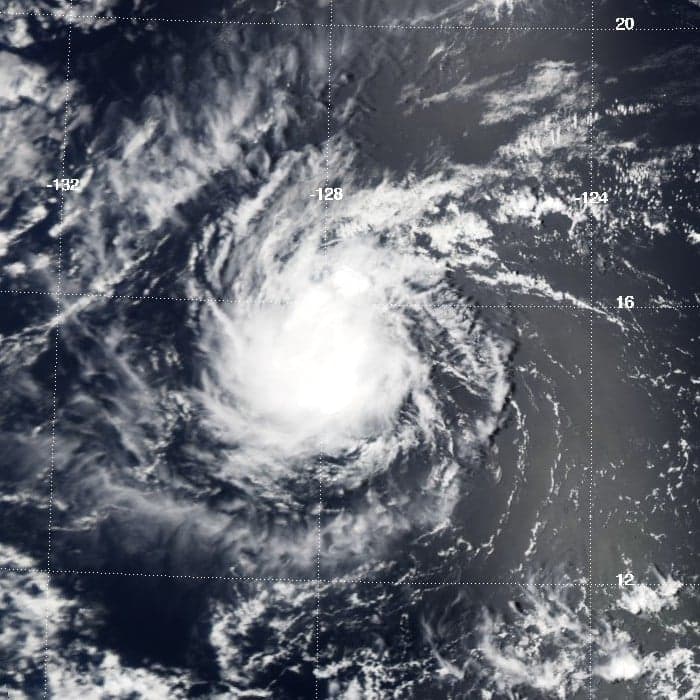

Recently, Hurricanes Irma and Harvey slammed into the coasts of the Caribbean and southern parts of the United States. These destructive tropical storms caused billions of dollars worth of damage combined and displaced millions of families. JP Morgan recently estimated that the insurance industry could lose $10 to 20 billion from Hurricane Harvey alone.