Cobalt, a key component in the production of lithium-ion batteries that power phones, computers, and electric vehicles, has soared in both demand and price in recent years. Lithium-ion batteries account for over half of global cobalt consumption, and with electric vehicle sales predicted to grow from 6.5 million in 2021 to 66 million in 2040, the appetite for the metal is understandably high. However, Cobalt is a unique commodity because it’s primarily controlled by only two countries: China and the Democratic Republic of Congo. The DRC supplies about 70 percent of the world’s Cobalt, but 80% of its industrial cobalt mines are owned or financed by Chinese companies. This dynamic has disproportionately favored China and has led to hostility among the Congolese government and its domestic mining companies.

globalEDGE Blog - By Author: Cade Ahlijian

Publish Date:

Imagine taking a walk down a busy street and asking everyone you see what they think of NFTs. Some will be unfamiliar with the term, some will claim they’re a revolutionary asset class, and some will roll their eyes and claim they’re a complete scam. While their long-term significance and utility within the global economy remain relatively unknown, one thing is for certain – They’re growing in popularity and sales volume at an exponential rate. This year’s sales of NFTs on trading platforms, valued at $27 billion, have already surpassed that of 2021.

Publish Date:

It’s safe to say that the global economy has been relatively trouble-ridden since the beginning of the pandemic. Many countries are struggling to find solutions to economic issues like high inflation, depreciating value of native currencies, and shortages. Unfortunately, with the ongoing Russia-Ukraine conflict, these issues are expected to intensify for the time being. Many western countries, including the U.S., Canada, UK, and European Union are imposing sanctions on Russia, further contributing to economic turmoil both in Russia and domestically.

Publish Date:

Sports play an important role in the lives of millions of people worldwide; they bring people together, they provide entertainment and exercise, and, often overlooked, they’re an engine for an extremely high-grossing industry. Globally, the sports industry has been estimated to be worth over $620 billion. Over the last 20 years, major sports leagues in the U.S. and Europe saw their respective clubs/teams grow their annualized revenue by about 7 percent, a performance matched only by the healthcare and education service sectors. One such league with a pronounced affinity for high-grossing activity is the NBA. The NBA has seen more profitability than any other league in the past few years, mainly due to its effective globalization to regions like China and Africa.

Publish Date:

The consumption of plant-based meat as simply a novelty is a thing of the past. As new health and sustainability-conscious generation of people grow older and play a bigger role in the global economy, the demand for plant-based meat is quickly increasing. Concerns about the substantial greenhouse gas emissions produced by the meat industry, recognition of animal cruelty, and knowledge of the long-term health risks of traditional meat consumption are all contributing factors. In 2020, as more people embraced flexitarian, vegetarian, and vegan diets, the market value of plant-based meat worldwide grew to 6.67 billion dollars. This figure is estimated to steadily increase over the next few years and reach 16.7 billion in 2026.

Publish Date:

Following a post-pandemic period of expansionary monetary policy, stimulus checks, and economic growth, the U.S. economy has been confronted with a new stage of high inflation. The annual rate of inflation in the U.S. hit 6.2% last month, its highest rate in more than three decades. While this has been a recent concern, it’s important to note that 85% of countries in the world are experiencing higher inflation rates than usual. Perhaps most negatively affected by high inflation is Turkey; its inflation rate has reached roughly 20%, the second-highest in the world behind Argentina (52%).

Publish Date:

As technology continues to advance at an exponential rate and becomes increasingly intertwined with our daily lives, it should be no surprise that non-fungible tokens (NFTs) are exploding in popularity and sales volumes. In fact, Global sales volumes of NFTs reached $10.7 billion in the third quarter of 2021, making an eightfold increase from the previous quarter. This magnitude of attention is eye-catching, to say the least, and it has businesses and individuals around the world taking action.

Publish Date:

Netflix has been considered the leader in the streaming market since its inception in the late 2000s, and its longevity of success is no mistake. While competition grows fiercer year after year and the U.S. streaming market becomes increasingly saturated, Netflix maintains the largest market share, and its success can be largely contributed to its international presence.

Publish Date:

While the holiday season is still a couple of months away, retail companies are preparing to face the looming pressures of the busiest stint of the year. Early predictions show an astounding 7-9% expected increase in retail sales and an 11-15% expected increase in E-commerce sales this holiday season, but companies are wildly unprepared for this increase in demand, as they are dealing with factory closures, shipping container shortages, and labor shortages.

Publish Date:

It’s no surprise that the effort to get the global economy back to its pre-pandemic efficacy would be quite challenging. The biggest current hurdle to that goal is what some are calling a global energy crisis. The supply of fossil fuels is struggling to catch up with recovering demand, causing energy prices to soar around the world, especially in the Northern Hemisphere as countries prepare for a cold winter. Many factors have contributed to this supply crunch, including European and Asian countries’ recent efforts to decarbonize the economy, lack of capital to natural gas drillers, and an unexpectedly low output from Russian energy suppliers like Gazprom.

Publish Date:

In the first eight months of 2021, global M&A activity has grossed $3.6 trillion, the highest mark at this point in the year since at least 1995, when Dealogic started keeping records. This unprecedented volume of activity has been aided by low interest rates, soaring stock prices, and executives’ ability to address the imperfections in their business exposed by the pandemic. The U.S. alone accounted for $2.14 trillion worth of M&A deals this year, while Europe and the Asia-Pacific accounted for $657 billion and $620 billion, respectively. This wave of deal-making has Wall Street setting records as well, as deal advisory revenue has reached new heights for multiple investment banks. It’s no surprise that Goldman Sachs is the best performing stock in the Dow this year, up 56%.

Publish Date:

Last week, the European Union released a draft of strict regulations regarding the creation and use of artificial intelligence (AI). This 108-page document of rules and regulations aims to ban or restrict multiple “unacceptable” uses of AI, which the European Commission deems as any AI system that is considered a clear threat to the safety, livelihoods, and rights of people. This includes the use of AI in a range of activities like hiring decisions, bank lending, school enrollment selections, court decisions, and facial recognition in public places. Although the EU’s proposal faces a long road before it becomes law, as it must be approved by both the European Council and European Parliament, it has profound implications for big tech and national governments around the world.

Publish Date:

Tulum, located in Quintana Roo, Mexico, is known for its modern bohemian-style atmosphere, its beautiful beaches and cenotes, and its eco-friendly nature. Just a decade ago, Tulum was relatively untouched and undeveloped, but it is now one of the fastest-growing destinations in the world for both vacations and residency. A big reason for this is the developers’ strict commitment to preserving Tulum’s natural beauty by building highly sustainable and environmentally friendly infrastructures. These efforts have attracted some of the world’s best architecture firms and novel real estate investors alike.

Publish Date:

On March 27, 2021, foreign ministers from China and Iran signed a cooperation agreement that is expected to massively stimulate Iran’s economy, as well as deepen China’s presence in the middle east in general. The agreement promises around $400 billion of Chinese investments to be made in multiple Iranian economic sectors like banking, telecommunications, ports, railways, and health care and information technology. In exchange, China will receive a heavily discounted supply of Iranian oil for the next 25 years. Iran’s main contributors to these oil exports will likely be the government-owned National Petrochemical Company and National Iranian Oil Company.

Publish Date:

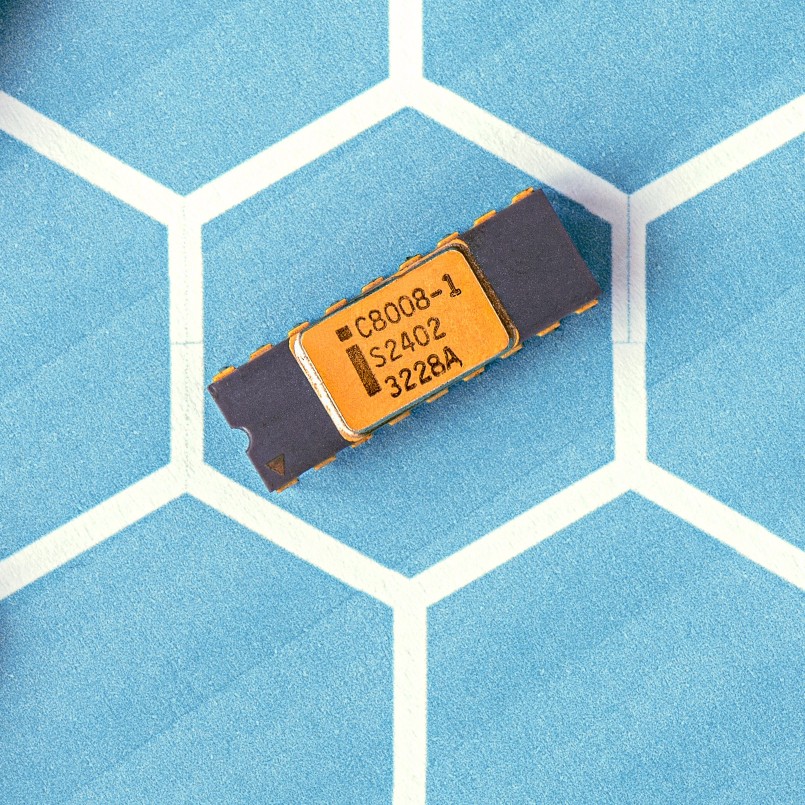

Last week, U.S. President Joe Biden signed an executive order that directs a review of supply chains that have been negatively affected due to the pandemic. The review is focused on four products—semiconductors, minerals and rare earths, pharmaceuticals, and advanced batteries. The goal of this executive order is to increase the domestic production of these products as well as increase imports from ally countries. The order mainly prioritized and placed heavy emphasis on semiconductors, as it included a $37 billion fund to dramatically increase semiconductor or “chip” manufacturing in the U.S.

Publish Date:

Electric vehicles have been around since the late 1800s, but they have only recently been discussed as the next big thing in the automotive industry. With increasing performance and technology improvements, government support, and lower production costs, electric vehicles are expected to have a huge impact on the industry in the coming decades.

Publish Date:

Xinjiang is an autonomous region of Northwest China, known for its vast deserts and mountains. Xinjiang is inhabited by several ethnicities, namely the Uyghur people of Turkish descent and the Han people of Chinese descent. The Uyghur and the Chinese have a long history of discord stemming from their religious differences, though it wasn’t suspected that there was severe oppression against the Uyghur people from the Han until early in 2020. It is now widely believed that the Chinese government has detained up to a million Uighurs over the past few years in “re-education camps.”

Publish Date:

Bitcoin, the digital currency created in 2009 by the mysterious pseudonym Satoshi Nakomoto, was known by few people on earth at its inception and was priced at less than a thousandth of a cent. It has grown to a current price of around $36,000 and is now debated as either the future of money or a worthless asset. It is an extremely unique currency in the way that it is an entirely digital token with no physical backing. It was created with the intention and ability to be a peer-to-peer technology, meaning no central authority or government can control it, making it entirely decentralized. This aspect of decentralization, along with many other unique features, have led many to believe that bitcoin could revolutionize the global financial system.

Publish Date:

Scientists and pharmaceutical companies alike are finally nearing the ending stages of preparing a vaccine for COVID-19 for commercial use. With at least 10 vaccine candidates currently in the early phases of human testing and two candidates likely to receive FDA authorization in the coming weeks, governments and citizens worldwide are eager to begin the end of the ongoing pandemic.

Publish Date:

London, the capital of the UK, was the top financial hub of the world for many years until it was surpassed by New York in 2018. This was mainly due to the financial complications that arose from Brexit, which was initialized in 2016, and will officially be set into motion on January 1st, 2021.

Publish Date:

On October 7th, two of the U.S.’ largest tech companies squared off in the Supreme Court via teleconference. Since 2005, Oracle and Google have been battling over whether common interfaces between software programs can be protected by copyright. The specific interface in question, known as an application programming interface, or API, lets certain software programs “speak” to Java programs. When Google developed the Android Smartphone over a decade ago, it used Java’s API, and because Oracle now owns Java, Oracle believes it’s owed money—$9billion to be exact. This has led to what some consider the copyright case of the century.